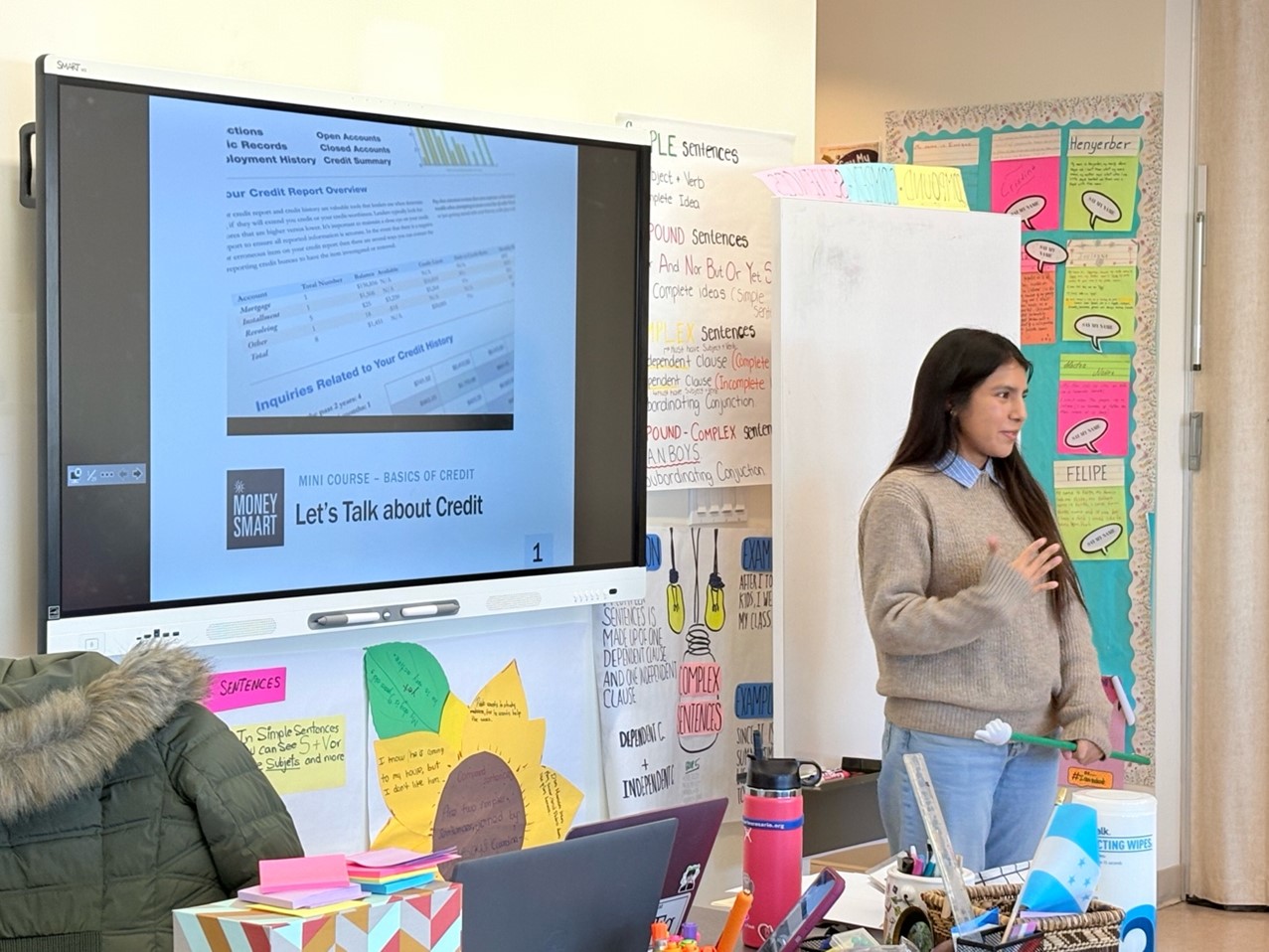

This spring, I piloted a financial literacy lesson at Carlos Rosario International Public Charter School. Carlos Rosario is a pro-bono adult education program, which teaches english to non-native speakers. I have had the privilege of working closely with Carlos Rosario students on their journeys toward personal and professional growth, as a volunteer in Ms. Monika Copelmayer’s english class. The focus of my lesson to the Rosario students was a topic that’s essential for immigrant families working to develop their financial literacy, and secure financial stability in the United States: credit.

Why Teach Financial Literacy at Carlos Rosario?

As a result of a lack of social programs to teach financial literacy to adults, or a lack of access to financial education in their countries of origin, many Carlos Rosario students have had little or no prior financial education. Without clear, accessible guidance on fundamental topics like banking, credit, and long-term planning, many are left without support while navigating complex, or unfamiliar financial topics. Motivated by the fact that I was also an immigrant to D.C. at a young age, my goal was to reach and interact more deeply with immigrant families in D.C. I wanted to show students at Carlos Rosario that financial literacy is a critical element of economic well-being.

By blending financial literacy education into trusted, community-centered educational spaces like Carlos Rosario, Dollar Scholars aims to help close the financial literacy gap, empower immigrants, and any other adults who lack access to financial literacy education. This approach extends beyond providing links to online resources, and helps the students connect with the material in a more personal way in the classroom.

Credit and Teaching Approach

Through my own education and experiences, I have learned that knowing how credit works—how to build it, protect it, and use it wisely—is an important element of long-term financial stability. Credit helps unlock access to home ownership, better jobs, and small business dreams.

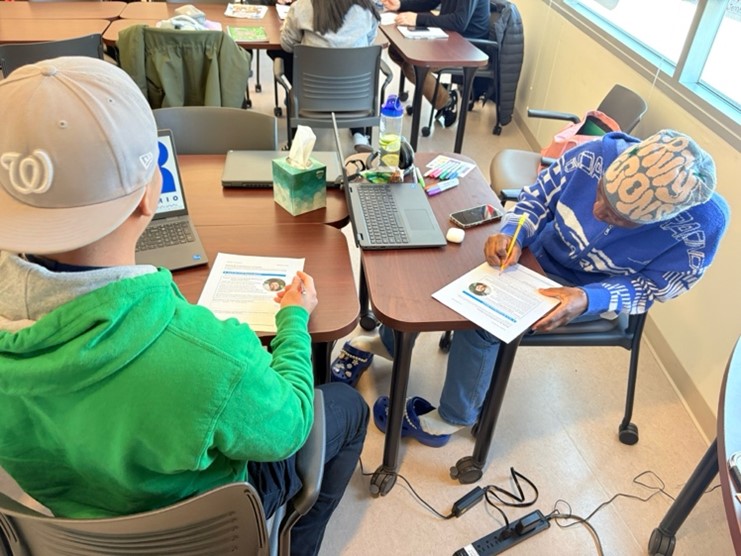

The lesson plan on credit was based on the Federal Deposit Insurance Corporation’s (FDIC)’s Money Smart for Adults curriculum. I aimed to make the material accessible, and engaging for the students. Using the FDIC teaching materials I used simplified definitions, incorporated graphical representations, and reinforced the lesson through group activities. The group activities were hands-ons and explored different scenarios such as applying for a credit card or reviewing a sample credit report. The goal was to make it easier for students to apply key concepts taught in the lesson to realistic financial situations.

Using the student’s responses from the pre-survey, I was able to tailor the lesson to focus on the key concepts voiced by the students at Carlos Rosario:

- What is credit?

- What is a credit score and what affects it?

- Why your credit score and credit report matters

- Practical steps to build and maintain good credit

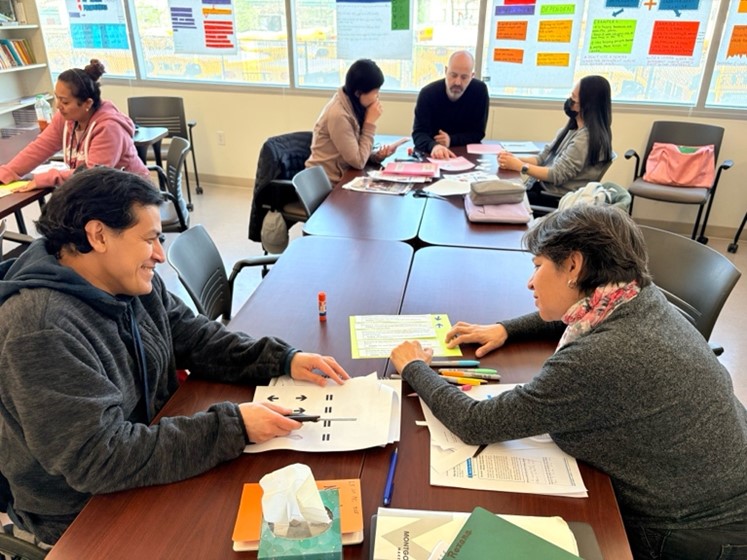

Throughout the lesson, students enthusiastically engaged with the material by asking questions, and participating in group activities. After class, several students followed up with more in-depth questions about credit, and the financial system in general, while others shared their personal experiences with credit. These interactions suggest that the lesson had an immediate impact, sparked genuine interest, and planted the seeds of financial empowerment within the students.

What I Learned

Many of the students I have worked with are doing far more than just pursuing their education: they are juggling multiple jobs, supporting their families, and attempting financial planning for the future. I feel it was a privilege to work with these individuals and I was encouraged by their curiosity, honesty and engagement. Their resilience and motivation inspires me to engage even more, and fuels my passion for helping the students at Carlos Rosario, and in our Dollar Scholars financial literacy classes.

The Carlos Rosario lesson is a single step, with hopefully more engaging programs and lessons to come. I’m incredibly grateful to Ms. Monika Copelmayer, and the wonderful students, for warmly welcoming me into their classroom. I deeply appreciate their willingness to engage openly with a topic that can often feel intimidating, unfamiliar, and uncomfortable.

(edited by Jeffrey Dickinson)