by Sophia Nayyar

Financial literacy is essential for achieving personal and financial security, yet significant gender disparities remain. Women, especially those from marginalized communities, often have lower levels of financial knowledge compared to men. This gap can have serious consequences, limiting women’s ability to make informed financial decisions and plan for their futures.

Research consistently shows that women score lower on financial literacy tests than men. A 2020 report from the Global Financial Literacy Excellence Center (GFLEC) found that women worldwide are less likely to answer basic financial questions correctly, especially regarding investments, budgeting, and retirement planning. In the U.S., the 2020 National Financial Capability Study (NFCS) by FINRA revealed that women have lower financial literacy scores compared to men, particularly in understanding complex financial concepts like inflation and risk diversification.

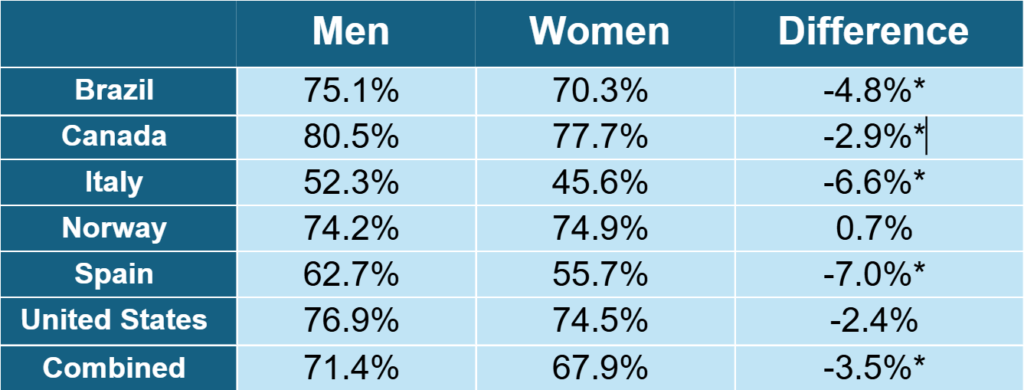

Our own data analysis, using 2022 OECD PISA data, reveals that high-school aged women are statistically less likely to receive financial education across several countries. In the United States there is a roughly 2 percentage point gap between the percent of men who receive formal financial education in high school, and the percent of women who receive formal financial education in high school. Though the difference is not statistically significant, it is strongly indicative, particularly in the context of the other data from our benchmark group of Brazil, Canada, Italy, Norway and Spain. Across all countries but the United States and Norway, there is a statistically significant difference between genders in terms of access to formal financial education.

Percent of women and men students who report having had any formal financial education.

The Impact of Financial Illiteracy on Women

The consequences of financial illiteracy are significant for women. Without a solid understanding of financial principles, women may struggle to manage their money, leading to debt accumulation and insufficient savings. Women are more likely to take career breaks for caregiving, and live longer, which may require additional adjustments in terms of long-term financial planning. This is particularly concerning for retirement planning, where a lack of knowledge about investment options or retirement accounts can leave women unprepared for their financial futures.

Women tend to earn less than men, with the U.S. gender pay gap remaining at about 17% in 2023, according to the U.S. Federal Government’s Bureau of Labor Statistics (BLS). A lack of financial literacy is likely a major factor in limiting women’s ability to negotiate salaries or understand financial terms in contracts, which perpetuates the gender pay gap.

Addressing the Gap: The Importance of Financial Education

Providing accessible financial education is a crucial step in closing the gender gap. Research shows that financial education programs can significantly improve financial behaviors, such as saving, debt management, and investing. A 2021 OECD report found that financial education, particularly programs tailored to women, can improve financial decision-making and boost confidence.

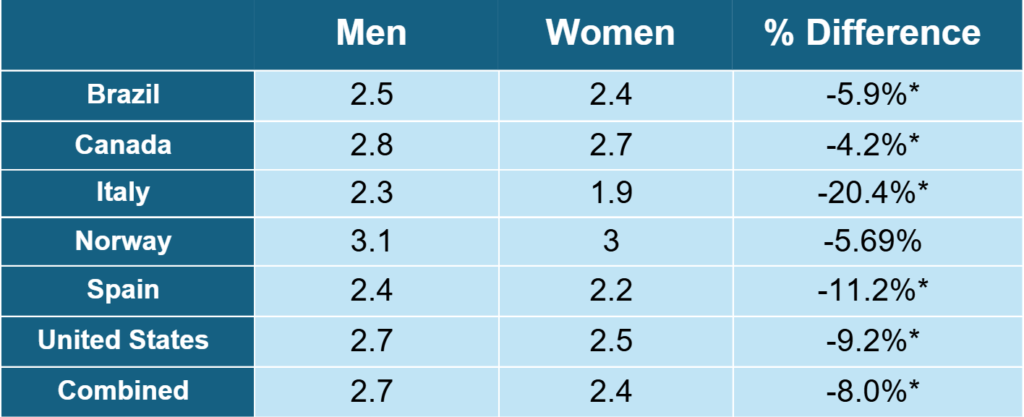

Confidence level of women and men using an electronic device to transfer money.

Digital financial literacy tools have been particularly effective in reaching women in underserved communities. The World Bank’s 2022 report highlighted that mobile-based financial education programs offer an accessible and flexible way for women to gain financial knowledge, breaking down barriers like language differences and limited access to in-person resources.

Overall, the gender gap in financial literacy remains a barrier to women’s financial empowerment. By addressing this gap through targeted education, such as the type we aim to provide at Dollar Scholars, we can equip women with the knowledge and confidence to make informed financial decisions.